September 2024 Newsletter

Welcome to Our Newsletter!

Welcome to the first Ignition Research newsletter! We hope that our newsletter will help you keep track of the latest developments in the areas of fusion energy and related technologies. We also cover many of the big drivers of electricity consumption such as electric vehicle charging networks, artificial intelligence (AI) data centers, high-energy industrial technologies, and electrification in the developing world. We are writing this newsletter for you, so please let us know what you think, and if there is anything you want us to cover. Thanks again for your time and interest!

What Is Ignition Research? Let Us Tell You…

The Ignition Research team comprises experts in energy and technology segments, partnership development, and market analysis with over 40 years of industry expertise in power systems, energy storage, EVs/EV charging networks, AI/Cloud, renewable energy, energy supply chains, and government affairs.

Ignition Research was founded to advance next-generation energy markets and understand how energy consumption will evolve. We aim to provide insights and actionable data that enable commercial and government leaders to make strategic investments in addressing our planet’s energy needs. We do this with market sizing forecasts, expert analysis, realistic business models, and pragmatic perspectives to enable “social license” to facilitate market transitions to occur and be profitable for all.

Highlights from TechConnect World 2024 – Fusion Energy

Ignition Research recently attended the TechConnect World 2024 Conference in Washington, D.C. (June 17-19), where a lot of great material was presented. One of the focus tracks at the conference was on the need and challenges of creating a supply chain for the fusion industry to fulfill subsystem needs such as thermal blankets, superconducting magnets, fuel systems, lasers, high-power capacitors, and high-voltage switching equipment that are critical to fusion.

The symposium was organized by Oak Ridge National Laboratory and Commonwealth Fusion Systems; chairs and speakers at the symposium included representatives from a number of fusion companies and suppliers such as Realta Fusion, Shine Technologies, EnableFusion, Kyoto Fusioneering, Pfeiffer Vacuum, and Tokomak Energy, as well as representatives from the US Department of Energy, the UK Atomic Energy Authority, and others. Some of the key points of the discussions during the symposium (which were heavily populated by people from tokamak-focused companies) included the following:

Most panelists agreed that commercialized fusion systems to generate electricity should begin appearing somewhere between the mid-2030s and early 2040s. They all (generally) agreed that the primary steps in fusion commercialization are: one-of-a-kind (bespoke) systems that demonstrate the technologies; pilot systems that are proof-of-concepts for commercial viability; and actual commercial fusion systems.

From the supply chain side, one subject mentioned by almost all of the panelists was high-temperature superconductor (HTS) tapes for the creation of superconducting magnets. Another topic of discussion was the development of thermal blankets, which harvest high-energy neutrons created during fusion, and use that energy to heat water to turn turbines. Both of these technologies are challenging today, both due to the materials needed and the lack of manufacturing base.

Other areas of challenge include vacuum pumps that can evacuate large areas while running in extremely strong magnetic fields; hydrogen ice pellet injectors; high-energy neutral beam injectors; and high-frequency gyrotrons.

While everyone was more or less positive about developing the fusion supply chain, there were also multiple mentions of the challenge of finding people to help develop fusion power. This wasn’t just for researchers; it also included welders, pipe fitters, and other trades that were required to build supply chain components in lieu of having a developed supply chain for the fusion industry.

Fusion Energy Market Sizing – The Needle in the Haystack

Late last month, Ignition Research released the 2024 Fusion Energy Worldwide Demand Report. The report looks forward through 2050 to forecast the size of the fusion market, as well as the key drivers on both the demand and supply side.

The biggest challenge when forecasting an emerging technology market such as fusion energy, the hardest things to quantify tend to be things like:

- What is the new technology’s value proposition (why does anyone want it)?

- What is the new technology replacing?

- When does the technology take off (reach critical mass or become commercialized)?

- What are the market enablers for this technology?

- What are the new technology’s competitors?

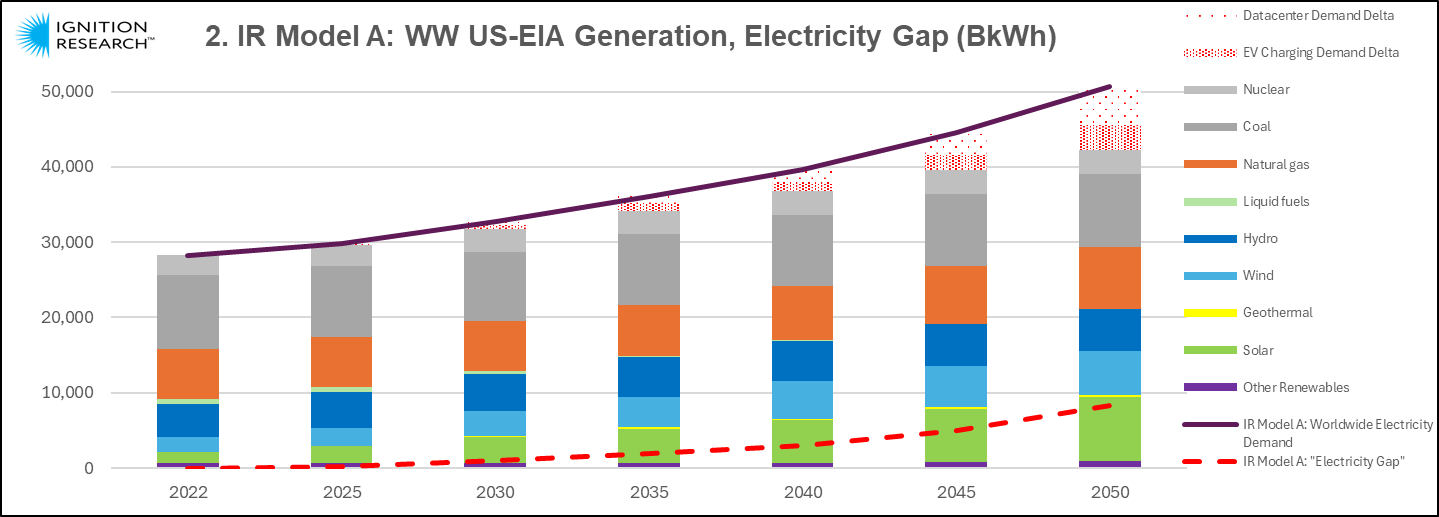

These factors drive the sizing of the fusion energy market, and an example of the lack of quantifiable information for fusion energy was that neither the US Energy Information Agency (US-EIA) or the International Energy Agency (IEA) included fusion in their 2022-2050 electricity generation forecasts. Sizing the fusion energy market is one of the key missions of Ignition Research, and the subject of our first market report. Below is an example of our most aggressive forecast for fusion energy by 2050. If you would like a prospectus, please contact us at info@ignitionresearch.com.

Venturing into Fusion Energy – Billions Creating Trillions

During the recent webcast “Fusion Energy – A Trillion Dollar Market?,” the question was asked: Why are billionaires and venture capital firms investing in fusion now? Simply put, “They can invest billions to make trillions.” There are few opportunities for the investment community to reach the scale and return potential of fusion energy (today, AI is probably the only other one). The fusion energy sector has seen a dramatic increase in private investment in recent years. According to the Fusion Industry Association, private fusion companies have raised at least $7.1 billion. Significant investments may have yet to be disclosed because most companies are private entities. Here is a list of companies that we believe have raised $100M or more for their fusion systems.

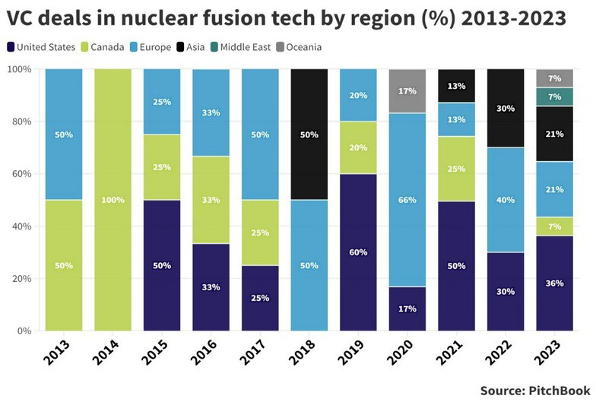

Fusion energy is a global game, and significant public and private investments are being made in every G20 country. Chain is expected to invest $1.5B this year, and the US will spend over $750M across multiple agencies. The following chart shows the international nature of VC investments.

Fusion is not the only emerging energy solution in this century – it is just the only one that enables replacement of existing energy technologies such as natural gas, coal, and liquid fuels. While solar and wind promise clean energy, they cannot be used for “brownfield opportunities” (i.e., replacing existing power plants in the same footprint). Fusion has these capabilities and while the time to payoff is greater, the potential.

As fusion technology continues to advance, venture capitalists clearly see it not just as a scientific endeavor but as a potentially lucrative opportunity to shape the future of energy. Their willingness to invest billions with long-term horizons reflects both the challenge’s scale and the potential rewards’ magnitude. These investments could turn billions into trillions while addressing critical global energy and environmental challenges.

The Issues With (Most) Renewable Electricity Resources

Despite the title of this article, please don’t get me wrong – I am a big supporter of solar energy (and other renewable resources). I have utilized solar electricity systems for my homes for at least fifteen (15) years. I also love the idea of solar parking lots such as the one pictured to the right of this article – it is a great way to keep people’s cars cool and provide power at the same time.

That said, both photovoltaic (PV) solar and wind-powered electricity have a number of issues that tend to raise their costs and reduce their effectiveness. The primary issue with both of these sources is known in energy industry parlance is “dispatchability”. A power source that is fully dispatchable (such as fossil fuels or nuclear power generation) can be arbitrarily turned up or down (to the maximum capacity of the power plant) to meet demand, regardless of season or time of day.

The problem with PV solar and wind power is that they are not dispatchable. PV solar only produces electricity when the sun is out, and wind power only produces electricity when the wind is blowing. Both solar and wind power also suffer from seasonal variation in their output (wind especially), and both are affected by weather conditions as well.

The typical approach for solving non- dispatchability is to utilize (one or more) energy storage solutions to “bank” power from renewable resources so that this power can be put back on the grid when PV solar and wind are not producing power. While this approach can work well for small-scale solar or wind deployments, they become more problematic as the scale of wind and solar deployments increase in capacity:

- If you want to achieve a certain amount of “constant output power” (say, 100MW) from your renewable resource, the actual amount of that renewable which you have to deploy increases dramatically. While use cases differ for a number of reasons (less power consumed at night; seasonal variations in solar output, weather effects on solar output, etc.), but in any case a lot more panels, and a large amount of battery storage would be required.

- The longer you have to store the power, the more lossy the storage system tends to be. For instance, wind power has large seasonal swings in power output (far more than solar), forcing the use of long-term energy storage solutions such as pumped hydro or subterranean thermal storage solutions. These solutions can have losses of up to 30%.

“New Energy” News – Fusion, EVs and EV Charging, Data Centers, etc.

Please visit our site https://4context.ai for curated newsfeeds and fun stories on “new energy” topics.