Most military and para-military conflicts over the past 3-4 millennia have been about either religion, resources, or simple conquest (increasing one country’s power and leverage at the expense of another). Since the end of World War II and the advent of nuclear and thermonuclear weapons, we have seen next to no direct conflicts between two or more nuclear-equipped powers (yes, the United States and China fought directly with each other in the Korean War, but China at that time did not have nuclear or thermonuclear weapons – it did not get the atomic bomb until 1964, and the hydrogen bomb until 1966). The rationale for this is obvious – the losing party in such a conflict, especially if loss threatened its political survival, would be strongly motivated to utilize nuclear or thermonuclear weapons to guarantee its survival.

Replacing direct conflict between superpowers (the largest nuclear-equipped countries with conventional armed forces capable of being projected globally) have been two other types of conflict:

- Proxy wars, where a superpower fights a “satellite” country/countries aligned with an opposing superpower, or where two (or more) non-superpower countries aligned with opposing superpowers fight a conflict. Examples include the Vietnam War, the Soviet invasion of Afghanistan, the Russian invasion of Ukraine, and the Syrian civil war (to name a few).

- Contests for economic, political, and military influence, where superpowers provide financial and military capabilities to countries to achieve political, military, and economic alignments. This has become a staple of the relationship between the United States and China, the two largest economies in the world today; the ‘prizes’ are typically non-aligned developing countries such as those in Africa and Southeast Asia, but to some extent have also included India and Eastern Europe as well. In many cases, access to energy resources, whether by the superpower (especially China) or the client states, is an integral part of this indirect conflict.

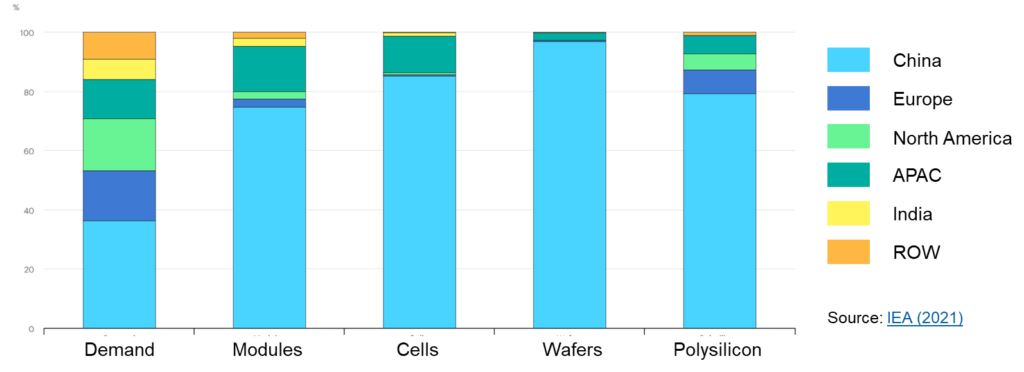

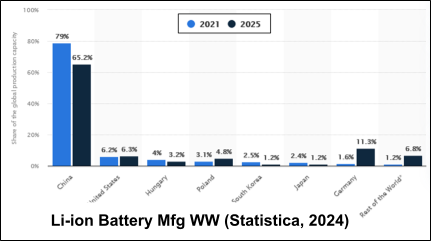

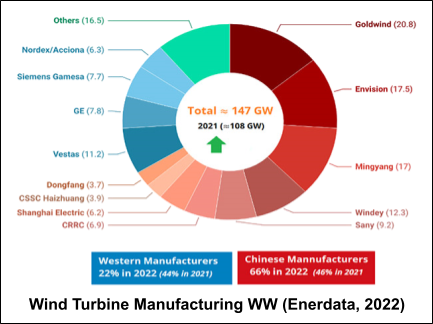

A backdrop to this conflict is the “war” for world manufacturing dominance, especially for the manufacturing of products required for the generation of energy. Currently, China dominates the manufacturing of several renewable energy and energy storage products, including photovoltaic (PV) solar cells (86% of solar cells worldwide), lithium-ion (Li-ion) batteries (65% of Li-ion batteries worldwide), and wind turbines (66% of worldwide market share). Solar alone is expected to grow 5X in market size between 2022 and 2050.

As a reference point on the difficulty of increasing market share, Germany invested ~€1B into the manufacturing of Li-ion batteries in 2019. This increased Germany’s market share from 1.6% in 2021 to 11.3% in 2025 (a cost of roughly €100M per each percent of market share increase). Worse yet, these renewable energy and energy storage product markets are all growing rapidly, which means that catching up to the leaders once you are behind becomes extremely difficult.

It is in the context of manufacturing dominance and economic, political, and military influence that the development of fusion energy becomes of particular interest and importance. Fusion energy represents perhaps the last big energy transition (at least for the next century or so), and the country/countries that dominate fusion energy will have an incredible advantage over other countries when it comes to trade negotiations, military alliances, and control of energy resources, especially given global climate change concerns.

The impact on internal economic growth of fusion cannot be understated either. For reference, the PV solar manufacturing industry in 2021 exceeded $40B in value, and created nearly 4M jobs, of which China alone gained 2.7M jobs. As a reference, we expect that the fusion energy market for plant construction and initial equipment alone will be will be nearly $1.7T in 2050 (equivalent to $740B in 2022 dollars), and will generate 24% of WW electricity in 2050. Commensurately, fusion energy will create roughly 34M jobs worldwide in 2050 just for the production of fusion machines and the construction of the fusion sites.

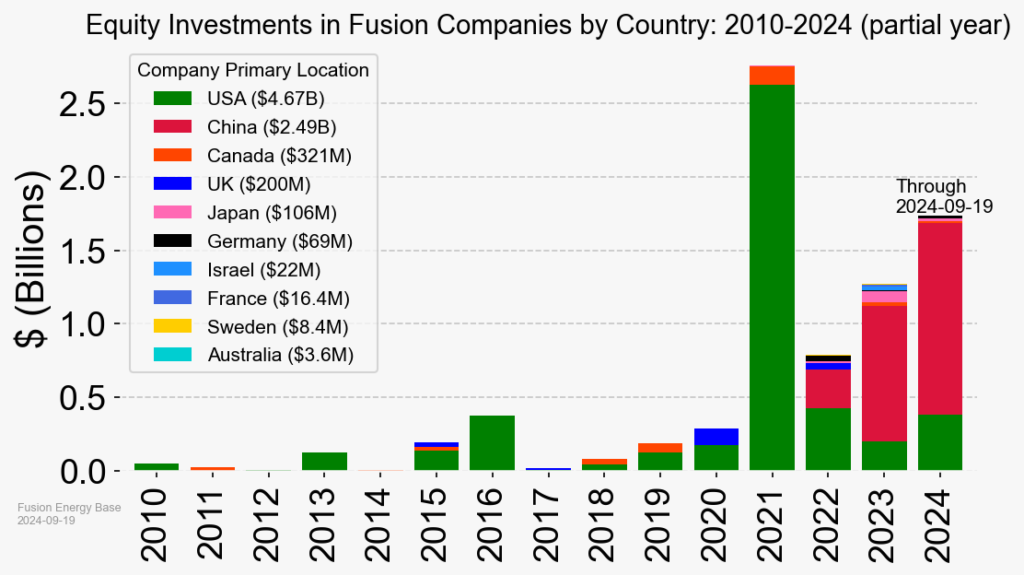

While the US historically led the world in innovation and investments in fusion energy (especially in 2021), the last two years (2023 and 2024) have seen Chinese public investments in fusion increase significantly. These investments have been both in fusion machine development and in building a supply chain for fusion’s critical subcomponents such as high-temperature superconductor (HTS) tapes (used to build the magnets for magnetic containment fusion), as well as in high-vacuum systems, lasers, energy storage and pulsed-power systems, in thermal blankets, and in fusion fuel injection systems. These investments reflect China’s realization that simply building a fusion machine does not ensure dominance in the fusion energy systems market; rather the country that “owns” the manufacture of these critical subsystems possesses the levers to own the fusion energy systems market. It should be noted that the investment number above also likely underestimate the actual size of China’s investment in fusion energy, as it is believed that many of its fusion programs are not publicly acknowledged.

So how do Western countries (the US, its European allies, and it’s Pacific allies such as Japan and Korea) maintain or improve their lead in fusion energy? There are three critical ingredients to this:

| Recipient | Latest Round | # Rounds | Total Funding | |

| Value | Date | |||

| CFS | $1.8B | Dec-21 | 6 | >$2B |

| TAE | $250M | Jul-22 | 17 | $1.3B |

| General Fusion | $22M | Aug-24 | 19 | $370.5M |

| Helion Energy | $500M | Nov-21 | 7 | $577.8M |

| Zap Energy | $130M | Jul-24 | 8 | $337.8M |

- Continue to push investment in commercial fusion energy companies: There are today twenty-five (25) active fusion companies in the US, with the five largest ones (Commonwealth Fusion Systems, TAE, General Fusion, Helion Energy, and Zap Energy) netting over $4.5B in their lifetime. Private companies represent an extremely important link in the development of commercial fusion because their goal that is exactly that – building viable commercial fusion power plants. While each of these companies has a different approach to the problem, it is likely that they (and not government labs) will build the first successful fusion energy power plants in the West.

- Push investment in the fusion energy supply chain: The critical subcomponents mentioned above need to be successfully commercialized if we are ever to build hundreds of fusion energy power plants per year, which is what it will take for fusion to replace fossil fuels in our electricity power mix. Without commercialized (and hopefully, somewhat standardized) versions of those critical subsystems, fusion power will not be commercially viable. Alternatively, if China dominates the manufacturing of these components, we will have the same problem that we do today with PV solar, Li-ion batteries, and wind turbines. This is an area where specific legislation can be helpful, both to help develop western supply chains, and to keep Chinese fusion energy component development from being funded by Western money.

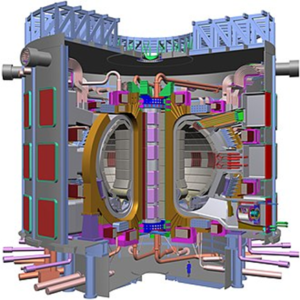

- Don’t mistake investments in scientific fusion machines like ITER for investments in fusion commercialization: I am NOT saying by any means that we should not continue to invest government funds into scientific fusion machines like the International Thermonuclear Experimental Reactor (ITER is pictured to the right; notice the man-scale figure at the bottom of the machine)).

Rather I am saying that Those investments need to be balanced against industrial policies that enable investment in commercial fusion energy companies, whether those are direct government investments in these companies, or indirectly though regulatory and taxation code changes that make such investments more “productive”. We just need to realize that project such as ITER will take longer than we expect, and should be seen as “longer-term” investments in fusion energy, rather than investments that help us commercialize fusion energy.

Rather I am saying that Those investments need to be balanced against industrial policies that enable investment in commercial fusion energy companies, whether those are direct government investments in these companies, or indirectly though regulatory and taxation code changes that make such investments more “productive”. We just need to realize that project such as ITER will take longer than we expect, and should be seen as “longer-term” investments in fusion energy, rather than investments that help us commercialize fusion energy.

The fusion energy race is one that the West cannot afford to lose, as the generation of clean energy will be one of the critical technologies of the 21st century and beyond. For countries that cannot afford to develop their own fusion energy systems and do not have extensive domestic energy resources, the price of buying (or more likely, renting) fusion machines from China will be strategically expensive to say the least. For the US and its allies to miss this opportunity to provide the world clean power while helping our own economies grow is not just costly – it is a “miss” that we may not get to fix for a very long time, and one that could pose an existential threat to our way of life.