How is Fusion Coming Along?

- Commonwealth Fusion (USA; $2B in funding)

- TAE Technologies (USA; $1.3B in funding)

- Helion Energy (USA; $577.8M in funding)

- General Fusion (Canada; $350.7M in funding)

- Neo Fusion (China; CN¥1.5B in funding – equivalent to $205M USD)

- Zap Energy (USA; $207.8M in funding)

- Tokomak Energy (UK; £123.1M in funding – equivalent to $150M USD)

- First Light Fusion (UK; $107M in funding)

- Kyoto Fusioneering (Japan; JP¥12.3B in funding – equivalent to $123M USD)

- Focused Energy (US; $79M in funding)

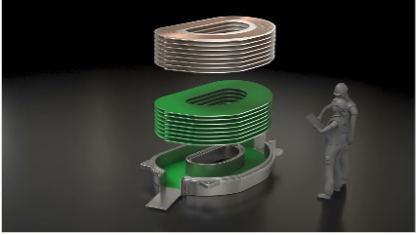

The totals above also do not count investments in related “critical technologies” for fusion energy, such as high-powered lasers, high-temperature superconducting (HTS) tapes (used to wind the magnets), containment vessels, thermal blankets (converts the power from high-energy neutrons into heat), high vacuum pumps, high-voltage switching, and high-power capacitors (used to provide “pulsed power” to lasers and magnets). Getting the above components with the right attributes to build fusion energy reactors, and in the right quantities, is critical to the commercialization of fusion energy for electrical power generation.

In the US, fusion companies are represented by the Fusion Industry Association (FIA), a non-profit organization founded in 2018 which currently has 25 members. One of its goals is to ensure that the supply chain for the critical technologies above continues to develop in lock step with fusion. Given the venture capital (VC) interest in fusion, one could easily say “fusion train” has left the station and is building up steam quickly…